How much does Professional Liability Insurance cost?

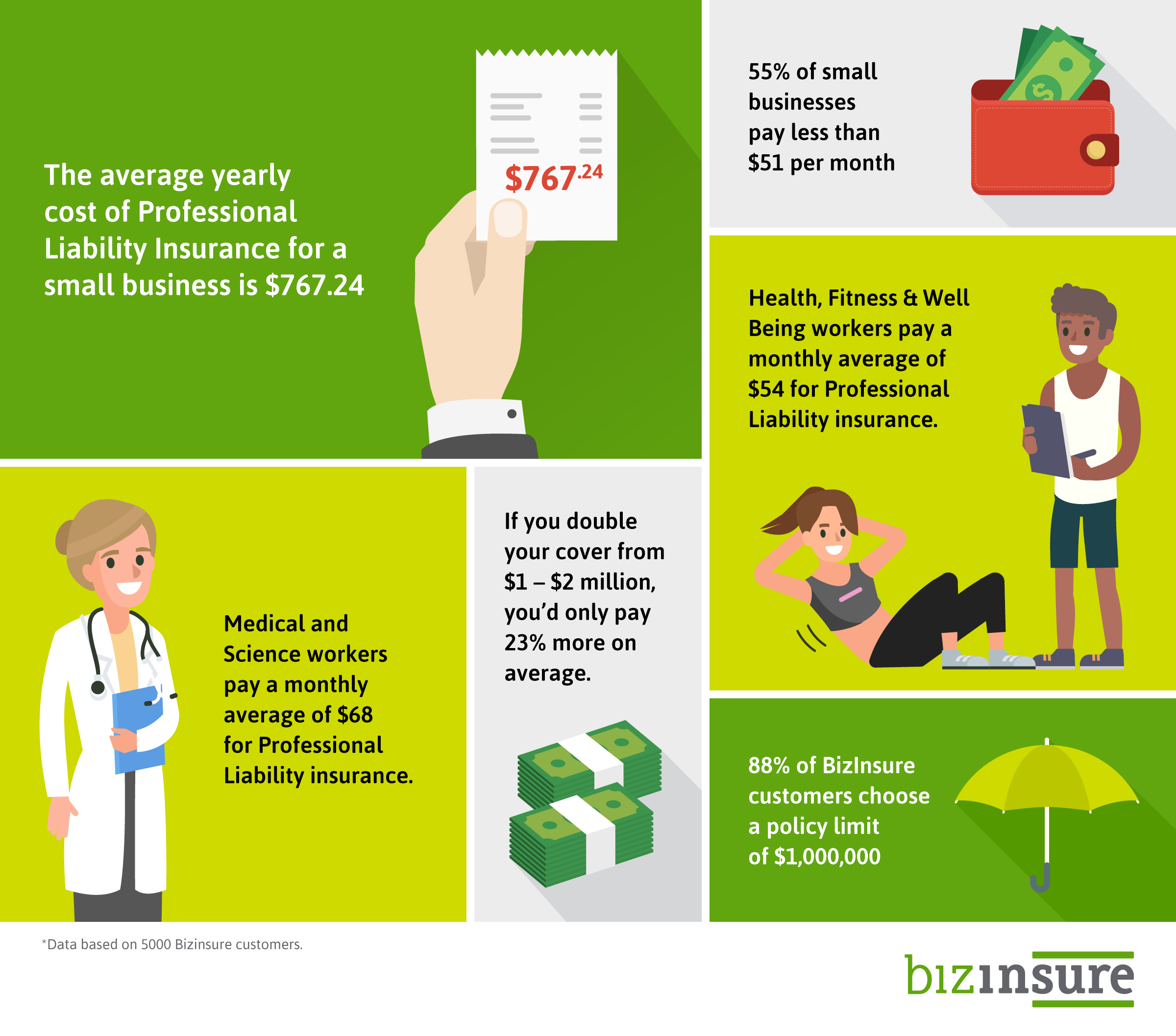

At Bizinsure, our analysis of more than 5000 of our customers showed that regardless of the industry or policy limits, the average yearly cost of Professional Liability Insurance for a small business is $767.24. As a yearly median cost this is $600.

Nevertheless, more than a third of small business owners pay less than $600 per year for their Professional Liability Insurance coverage.

What is the average monthly premium for Professional Liability insurance?

Small business owners can expect to pay on average around $63.93 per month for Professional Liability insurance.

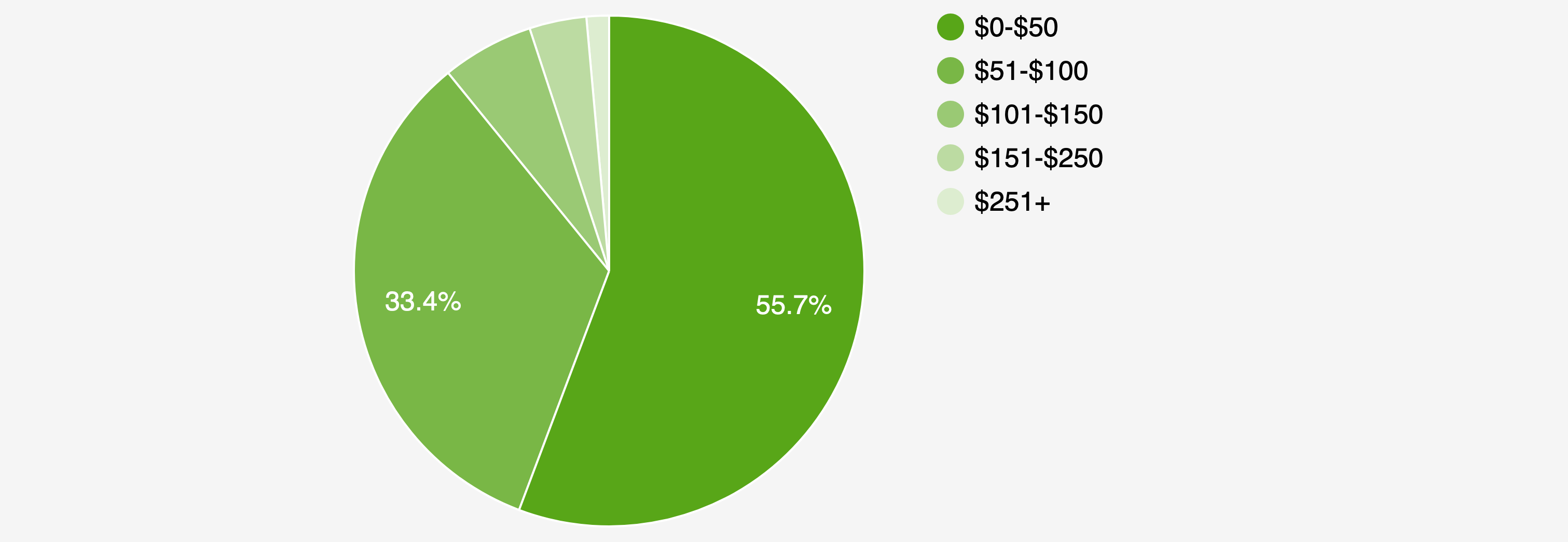

From our analysis, we have found that around 55.7% of small businesses pay less than $51 per month; while around 33.4% pay around $51-100 per month for their Professional Liability insurance.

Below is the full breakdown:

Average monthly premium for Professional Liability insurance?

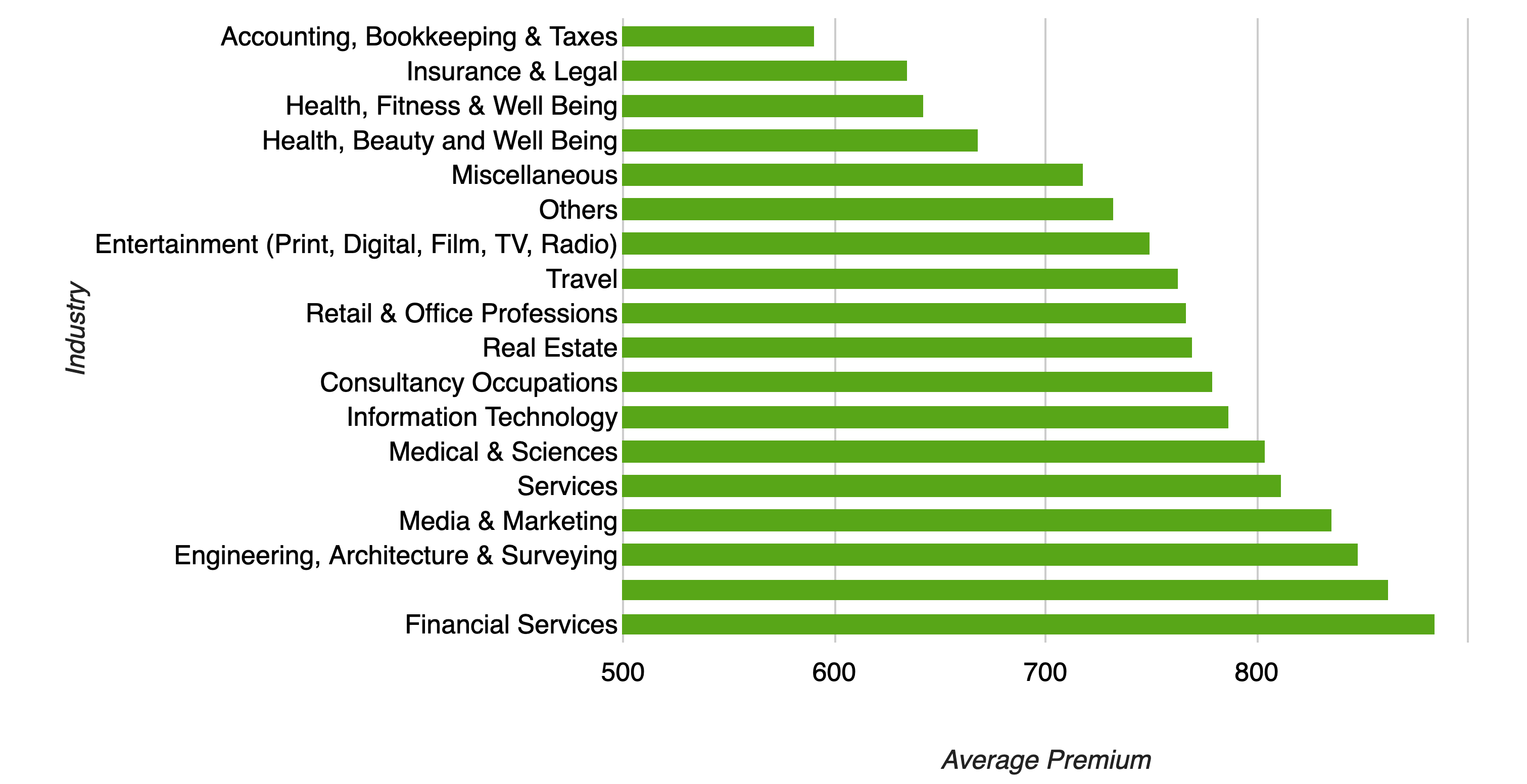

What is the average cost of Professional Liability insurance by industry?

A lot like General Liability Insurance, the industry your business operates in, does have an impact on what you will pay for your Professional Liability Insurance policy. One of the easiest ways to look at it is the higher the risk of your business being sued, the higher the cost of your policy.

When you apply for a Professional Liability Insurance policy, there are a few things which your business will be assessed on before coming back with a price. One of the most important things insurers will look at is what would be the possible cost for loss or damages if a claim were to result from your negligence.

Here’s a breakdown of professional liability insurance cost by industry:

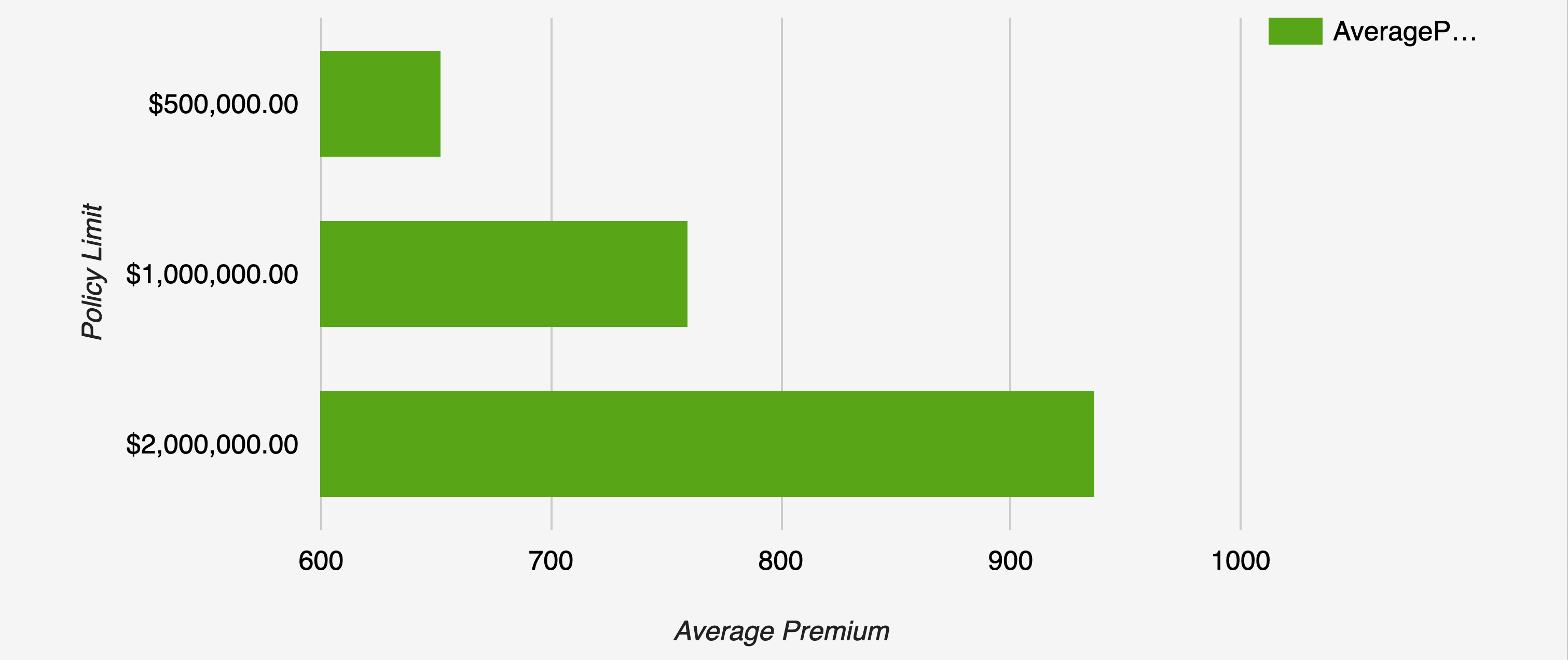

How Policy Limit Impact The Cost Of E&O Insurance

Looking at the graph above, you will notice that Engineering, Architecture and Surveying industries attract a higher premium. This is because these professions are exposed to a higher risk of a claim occurring, for example, if an engineer makes an error in the construction of a building, it could collapse, and people could potentially die. Compared to a lower risk industry like Accounting & Bookkeeping, the cost of a potential claim is a lot less given the risks associated with the profession.

What Do Small Businesses Pay for Professional Liability Insurance?

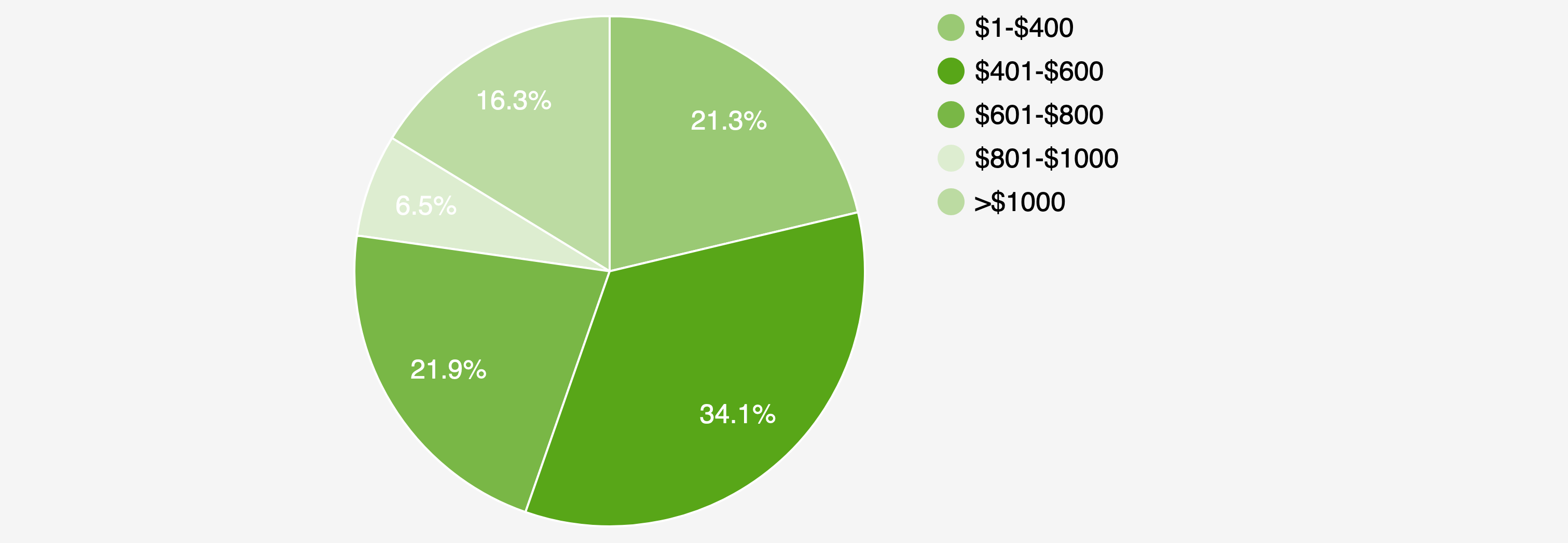

Every business is unique and is exposed to its own level of risk factors, meaning there are varying costs for each business and their Professional Liability Insurance coverage. While it’s hard to pinpoint precisely how much a small business will pay exactly for their policy, we have found through our analysis, that approximately 55% of small business owners can expect to pay less than $600 per year for their Professional Liability policy.

Besides the coverage limit, a business may take out with their Professional Liability Insurance policy, there are some other factors which also need to be considered such as:

- The amount of staff your business has – the more people you have involved in your business, the higher the risk of a claim taking place.

- Your business’s turnover – Put simply, if your business is producing a higher turnover, it is a good indicator that your business is performing a greater volume of work. When more work is being performed, there is a higher chance of something going wrong and claim being made against your business. One of the other key indicators of a large turnover arises when a business takes on high-value contracts, which could result in expensive settlements if something were to go wrong.

- The individuals being covered – are they qualified for the job they are performing, and do they have a previous history of claims?

- Your individual claims history

Below you will find a full breakdown of the different premium ranges:

What Do Small Businesses Pay for Professional Liability Insurance?

Which Professional Liability Insurance Limits Do Small Businesses Choose?

We don’t want to bore you too much facts the facts and figures , but like many things which we purchase often the higher the level of coverage, level of service or quality of the product the more we pay and the same can be said for Professional Liability Insurance policies. A policy which is going to offer increased coverage is going to cost more than a policy with less coverage.

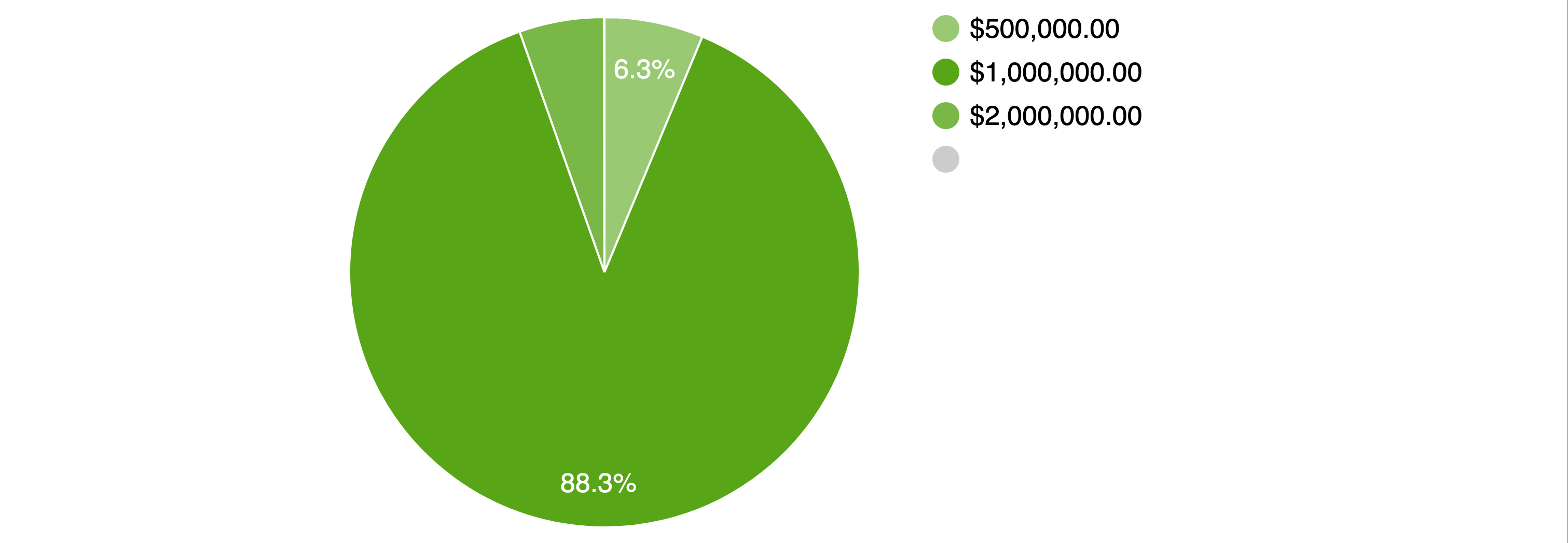

So which policy limits are small business owners choosing? Analysis of the policy limits our Bizinsure customers are taking points to the most popular policy limit option they are taking out is $1,000,000, which accounted for 88% of the Professional Liability Insurance policies sold.

Every business has its own exposure to risk, which varies from industry to industry, so while $1,000,000 as a limit may be the most popular policy limit, be sure to check the amount of coverage that suits your own business.

Other factors which small business’ take into consideration when selecting the limit of their policy coverage include:

- Legislative and/or industry association requirements – For some particular occupations, a minimum amount of coverage is required before opening and operating your business

- Contracts – If your business accepts contracts you will need to think of how much coverage is enough coverage in the event that something could go wrong and where you could be held liable.

- How many employees do you have? A good way to look at this is the more employees you have, the more likely the chance of a claim occurring, and in the unfortunate event a claim were to arise could you pay multiple claims at once?

Here is a further breakdown into the popularity of the various limits for Professional Liability Insurance:

Which Professional Liability Limits Do Small Businesses Choose?

Here’s everything BizInsure covers for your business from General Liability Insurance, Professional Liability Insurance, also known as Errors & Omissions insurance (E&O), Workers Compensation Insurance, and Business Owner’s Policy.

How Policy Limits impact Professional Liability Insurance?

Unfortunately, the higher the policy limit of a Professional Liability Insurance, the higher the cost of the policy. However, it is also reassuring to know that the more you pay for your policy, the more coverage your business will also be protected.

Some businesses calculate their limit based on the level of risk which they feel they will be exposed to, while other business’ may need to take out a set limit that is required in a client contract.

How Policy Limits impact Professional Liability Insurance?