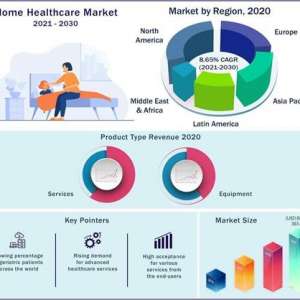

The U.S. home healthcare industry is experiencing significant growth, with the industry projected to reach $381.40 billion by 2033. This expansion is driven by an aging population, an increase in chronic health conditions, and supportive reimbursement structures for home-based care.

Understanding the risks of inadequate insurance

Operating a home healthcare agency involves various risks, including staff injuries, client claims, and property damage. Without appropriate insurance coverage, these risks could lead to devastating financial losses or a negative business reputation. Insurance helps provide a safety net, ensuring business continuity and protecting against unforeseen events.

Essential insurance policies for home healthcare providers

Home healthcare agencies may consider many types of insurance to help manage different risks. Popular forms of coverage include:

Compulsory insurance requirements

Requirements vary by state, but home healthcare providers may be required to have:

- General Liability insurance: Protects home health business against bodily injury or property damage lawsuits from outside parties. It’s a fundamental policy for protecting businesses from lawsuits.

- Professional Liability insurance (Errors and Omissions): Protects professional service providers from potentially devastating financial damages resulting from alleged negligence or error in the delivery of their services. For home healthcare providers, this coverage applies to allegations of improper care or failure to follow professional standards.

- Workers’ Compensation insurance: Required in most states, this insurance protects against medical expenses and lawsuits that can arise from employee workplace injuries and illnesses. It could also pay lost wages as a result of the work injuries that an employee sustains. It’s necessary for agencies with staff working in patients’ homes or other settings.

Additional Considerations

Agencies may also consider additional coverage options, such as:

- Cyber Liability insurance: As agencies increasingly store client information digitally, this insurance protects against data breaches, hacking, and other cyber threats. BizInsure offers a combined Professional Liability/General Liability policy for home health businesses that also includes Cyber Liability coverage.

- Commercial Auto insurance*: If staff drive company vehicles or use personal vehicles for client visits, this coverage protects against accidents, injuries, and vehicle damage related to business activities.

- Umbrella insurance*: Provides extra coverage above the limits of your existing policies. This is helpful for large claims that exceed standard policy limits.

*Please note: BizInsure does not currently offer Commercial Auto or Umbrella policies.

By securing comprehensive insurance coverage, home healthcare providers can mitigate risks and ensure the sustainability of their services.