How much does Errors & Omissions Insurance cost?

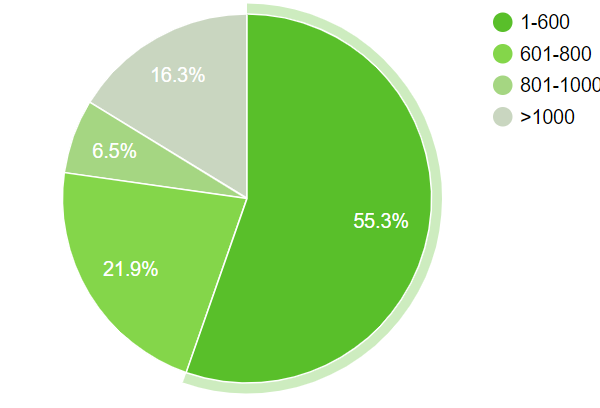

At Bizinsure, we analyzed data from more than 5000 of our customers showed that regardless of the industry or policy limits, the average yearly cost of Errors & Omissions Insurance for a small business is $767.24. As a yearly median cost this is $600.

However, as you can see from the chart below, 55% of small-business owners who buy an of Errors & Omissions Insurance policy through BizInsure pay less than $600 per year.

Average Monthly Premium For E&O Insurance

What Factors will affect Errors & Omissions Insurance Cost for Small Business

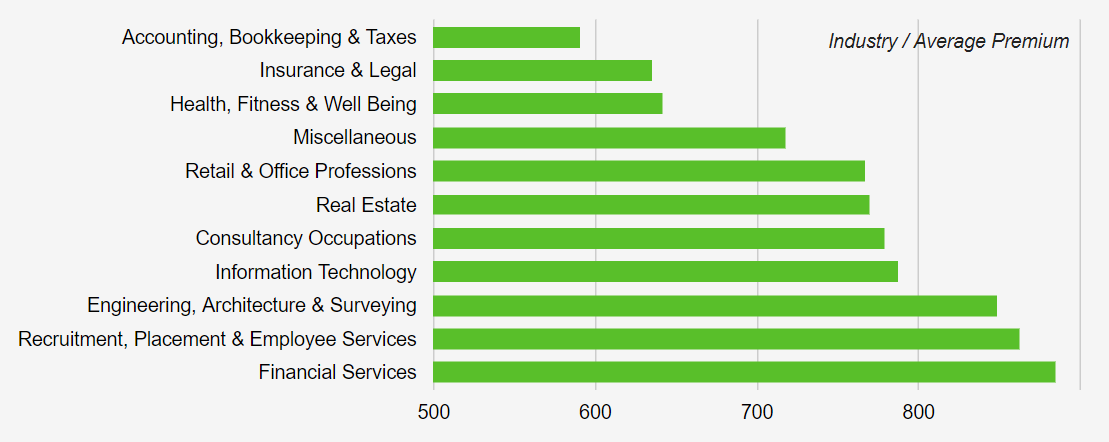

The industry your business is operating in

A lot like General Liability Insurance, the industry your business operates in, does have an impact on what you will pay for your Errors & Omissions Insurance policy. One of the easiest ways to look at it is the higher the risk of your business being sued, the higher the cost of your policy.

When you apply for an Errors & Omissions Insurance policy, there are a few things which your business will be assessed on before coming back with a price. One of the most important things insurers will look at is what would be the possible cost of loss or damages if a claim were to result from your negligence.

Here’s a breakdown of Errors & Omissions Insurance cost by industry:

Average Cost Of E&O Insurance By Industry

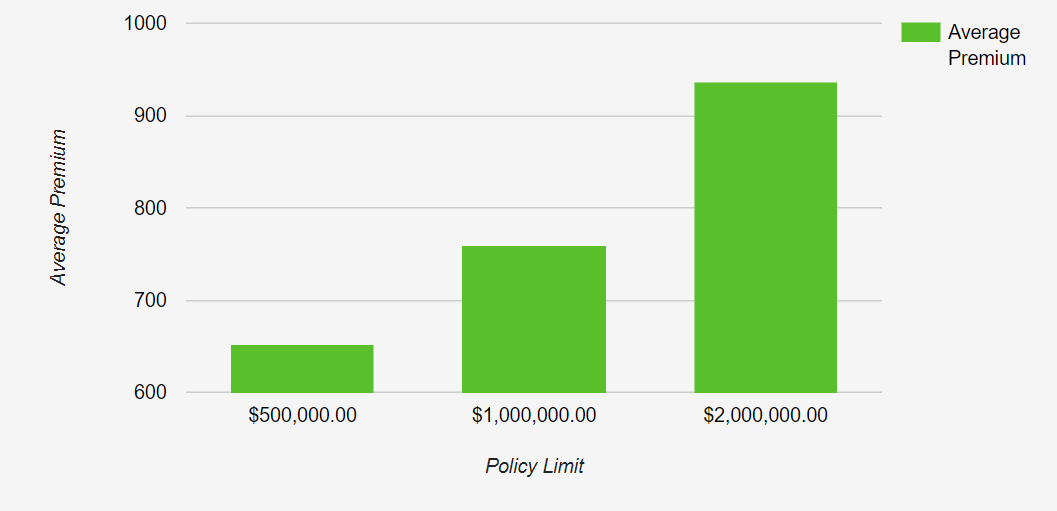

Policy Limits You chose

Policy limits have a huge impact on the cost of Errors & Omissions Insurance. They determine how much coverage a business receives, As you can see from below chart, the higher the level of coverage, level of service or quality of the product the more we pay.

How Policy Limit Impact The Cost Of E&O Insurance

Factors which small business’ take into consideration when selecting the limit of their policy coverage include:

- Legislative and/or industry association requirements– For some particular occupations, a minimum amount of coverage is required before opening and operating your business.

- Contracts – If your business accepts contracts you will need to think of how much coverage is enough coverage in the event that something could go wrong and where you could be held liable.

- How many employees do you have? A good way to look at this is the more employees you have, the more likely the chance of a claim occurring, and in the unfortunate event a claim were to arise could you pay multiple claims at once?

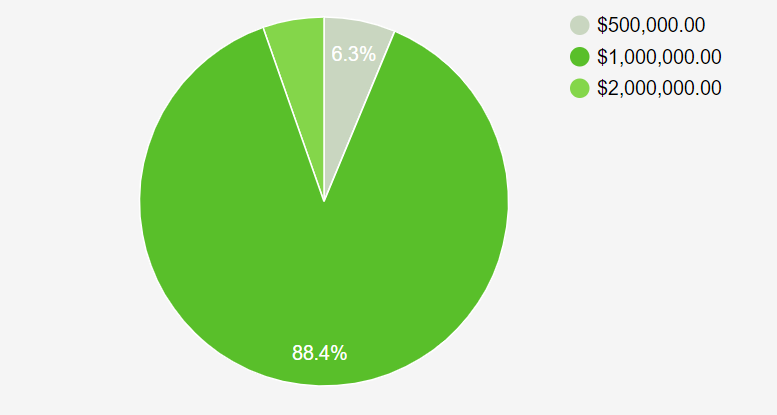

Here is a breakdown into the popularity of the various limits for Errors & Omissions Insurance also known as Professional Liability Insurance

Which E&O Insurance Limits Do Small Business Choose?